准备

- Google Colaboratory(※Jupyter Notebook也OK)

- 分发源代码(*如果您只想从头开始,则不需要)

使用技术

Python

Qiskit

你做了什么

家乡税务上限模拟 × 乐天 API 集成 × 量子计算 × 优化问题

在“故乡纳税有翻译”中

,从乐天API获取故乡纳税返还品一览表,

求解组合优化问题之一的背包问题的量子算法

(QAOA:量子近似优化算法)中

,在模拟中得出的扣除上限金额中

总重量最重的返还礼品的组合

无论如何,我制定了一个计划,通过家乡纳税。

评论

稍后,在乐天 API 的搜索词中包含“翻译”是为了放大吝啬感。

我们专注于用户、业务和技术,例如

如何使用数学、算法、最新技术和数据

来解决某人的问题。

量子算法的工作方式目前没有用法,

但经典(为了方便起见,我别无选择)程序可能会变得有帮助。

但是,扣除上限详细信息模拟只有相当的精度。

如果你“做正确的事”,你不仅需要谷歌老师,还需要一个强大的税务会计师。

(一个熟人的税务会计师必须让主任参与进来)

如果你想要一个精确的计算或更快的处理,你必须

完全熟悉量子计算和家乡税收的基本原理,或者

你妥协的包和简单的模拟。

关于QAOA(量子近似优化算法)

量子绝缘计算 (QAA) 中的结束状态(导致最佳解的哈密尔顿)为 $C$,初始状态(基能量状态的哈密尔顿)为 $B$。

在这里,作为任何角度参数,使用伽玛 $(γ)$ 和 beta$(β)$ 将$C $ 和 $γ$ 的统一矩阵定义为 $U(C,γ)$,将$B$ 和 $β$ 的统一矩阵定义为 $U(B,β)$。

$$

U(C, γ) = e^{iγC}… ①

U(C, β) = e^{iγB}… ②

$$

此外,使用上述统一矩阵的迭代次数为整数 $p$,将 $(β1,γ2,…,伽马 p)$ 作为元素的矢量γ$,将 (β1,β2,…,βp) $ 作为元素的矢量定义为 $β$,将 p 维的正交基矢量定义为 $|s]$,定义以下运算符 $|γ,β] $。

$$

|γ, β> = U(B, βp)U(C, γ_p)U(B, β{p-1})U(C, γ_{p-1})… U(B, β_1)U(C, γ_1)|s>… ③

$$

然后,使用上面定义的运算符 $|γ,β]$ ,确定导致最佳解决方案的哈密尔顿 $C$ 的预期 $Fp$,如下所示。

$$

F_p(γ, β) = <γ,β| C|γ,β>… ④

$$

更改角度参数 $γ$ 和 $β$,以探索$F_p 可能的最大值M_p。 $

$$

M_p = max_{γ,β}F_p(γ,β)… ⑤

$$

当确定最大值M_p时,确定γ、β,同时确定 $C$ 对 (4) 的期望值,同时确定给出最佳解决方案的组合的状态。

- 统一矩阵:复数正向矩阵

- 哈密尔顿:系统的全部能量

- 系统: 某种集合

- 预期值:预测平均值

- 伊辛模型:由两个状态的网格点组成的网格模型

关于背包问题

定义

$I={1,2,…,N}$是商品的集合。

当每个商品的重量为 $i in I$

的权重为 $w_i$ 价值为 $v_i$

商品重量的总上限为 $W$ 时

,将出现以下内容称为背包问题。

$$

max ∑{i in I}v_iw_i s.t. ∑{i in I}v_iw_ile W

xin mathbb{N}(forall in I)

$$

其中$x_i$ 表示要放入背包中的物品数。

解决方案

问题是,如果你搜索整个数字,你会尝试两个选项,“选择或不选择物品”,只有几分钟的货物,计算金额是$O(2^{| I|}) 成为$ 但是,通过有效的贪婪方法的解法是已知的,在这里显示了解决方案。 这个问题的渐化公式是

$$

V(i,w)

=begin{cases}

{0quad if;i= 0,or,w = 0}

{V(i-1,w)quad if;w_i>w}

{max(V(i-1),V(i-1,w-w_i)+v_i)quad otherwise}

end{cases}

$$

成为。 此处,$V (i, w) $ 的值表示重量之和为 $w$ 或更少时,可以使用下标为 $i$ 或更低的商品实现的总价值的最大值。 这个公式是

- 当“一个不能选择一件物品”或“最大重量为 ${显示样式 0}{显示样式 0}$”时,由于没有要包装的物品,因此所选项目的总价值为 ${显示样式 0}{显示样式 0}$

- 如果项目 ${显示样式 i}$ 的权重超过 ${显示样式 w}$,则无法添加项目 ${显示样式 i}$,因此总值是项目下标上限为前一个值的最大值。

- 如果项目 ${显示样式 i}$ 的权重不超过 ${显示样式 w}$,则不添加项目 ${显示样式 i}$ 的值最大值应为不小的值。

它表示。 伪代码如下所示。 总价值的最大值为 $V(| I|,W) 作为 $ 获得。 此外,还需要添加代码来枚举所选项目。

- 渐化公式:用前一个术语表示的具有几列的项的项

在量子退行的伊辛模型中求解背包的公式

在 $1 模型中求解时定义哈密尔顿尼安

$H = BBigl(W-sum_iw_ix_iBigl)^2-sum_iv_ix_i$

*$B$ = 超参数

程序

软件包安装

!pip install matplotlib

!pip install seaborn

!pip install japanize-matplotlib

!pip install qiskit_optimization

!pip install qiskit-aer

!pip install ortoolpy

!pip install pulp包导入

from typing import List

import math

from qiskit_optimization.applications import Knapsack

from qiskit.algorithms import QAOA, NumPyEigensolver, NumPyMinimumEigensolver

from qiskit.utils import QuantumInstance

from qiskit import Aer

from qiskit_optimization.algorithms import MinimumEigenOptimizer

from typing import List

from ortoolpy import knapsack

from pulp import *

import requests

import numpy as np

import pandas as pd

import time

import japanize_matplotlib

import copy

import random

from IPython.display import HTML

%matplotlib inline定义家乡税收抵免限额计算类

class Calculator():

income: int = 0 # 总收入

donation_amount: int = 0 = 捐赠金额

resident_tax: int = 0 = 居民税额

def __init__(self, income: int, donation_amount: int, resident_tax: int):

self.income = income

self.donation_amount = donation_amount

self.resident_tax = resident_tax

• 考虑扣除上限的家乡税扣除额的结果

def deduction_result(self):

• 所得税扣除限额 =总收入的 40% 或更少,居民税基本部分扣除限额 = 总收入的 30% 或更少,居民税特殊部分扣除限额 = 个人居民税收入百分比的 20% 之一

if (self.income_tax_deduction() <= self.income * 0.4) or (self.basic_resident_tax_deduction() <= self.income * 0.3) or (self.special_inhabitant_tax_deduction() <= self.income * 0.2):

return self.deduction_limit()

else:

return self.hometown_tax_deduction()

• 扣除限额

def deduction_limit(self):

• 个人居民税收入×20% / 100% - 居民税基本部分 10% - (所得税率×重建税率 1.021) + 2,000 日元

return (self.resident_tax * 0.2 / (1 - 0.1) - (self.income_tax_rate() * 1.021)) + 2000

• 家乡税扣除额

def hometown_tax_deduction(self):

• 所得税扣除额 + 居民税基本扣除额 + 居民税特殊扣除额

return self.income_tax_deduction() + self.basic_resident_tax_deduction() + self.special_inhabitant_tax_deduction()

• 所得税扣除额

def income_tax_deduction(self):

• (家乡税捐赠金额 - 2,000日元)×(所得税税率(0-45%)×1.021)

return (self.donation_amount - 2000) * (self.income_tax_rate() * 1.021)

• 居民税基本扣除额

def basic_resident_tax_deduction(self):

• (家乡税捐款 - 2,000日元)×10%

return (self.donation_amount - 2000) * 0.1

• 居民税特别扣除额

def special_inhabitant_tax_deduction(self):

• (家乡税捐赠金额 - 2,000 日元) × (90% - 所得税率×1.021)*1

return (self.donation_amount - 2000) * (0.9 - (self.income_tax_rate() * 1.021))

• 所得税率

def income_tax_rate(self):

tax_rate = [0.05, 0.10, 0.20, 0.23 ,0.33 , 0.40, 0.45]

borders = [i*10000 for i in [0, 195, 330, 695, 900, 1800, 4000, np.inf]]

deduction = [0, 97500, 427500, 636000, 1536000, 2796000, 4976000]

special_tax = 0.021

step = len(tax_rate)

answer = 0

i = 0

while i <= step:

if (self.income >= borders[i]) and (self.income < borders[i+1]):

answer = tax_rate[i]

i+=1

return answer定义家乡税收抵免上限详细模拟类

class Simulator():

my_income: int = 0 = 您的工资收入

spouse_income: int = 0 = 配偶的工资收入(丈夫或妻子)

listed_capital_gain: int = 0 = 股票转让收益(上市)

unlisted_capital_gain: int = 0 = 股权转让收益(未上市)

total_income: int = 0 = 总收入

spouse: int = 0 # 配偶

spouses: 列表 [str] = [无', '是(69 岁以下)', '是 (70 岁以上)'] = 婚姻状况

widow: int = 0 # 寡妇

widows: 列表 [str] = [“非适用”, “寡妇”, “单亲(女性)”, “单亲(男性)”= 是否属于寡妇?

has_handicap: int = 0 = 是否存在残疾

handicap = { # 残疾人

“通用”: 0, # 一般 (人)

“separated_special”: 0, # 分居特别 (人)

“together_special”: 0 = 特别同居(人)

}

has_support: int = 0 = 受抚养人的存在

支持 = { = 受抚养人人数(丈夫或妻子除外)

"under_15": 0,

"from_16_to_18": 0,

"from_19_to_22": 0,

"from_23_to_69": 0,

"over_70": 0,

}

spouse_deduction: int = 0 = 配偶扣除额

widow_deduction: int = 0 = 寡妇扣除

handicap_deduction: int = 0 = 残疾扣除额

support_deduction: int = 0 = 受抚养扣除

basic_deduction: int = 0 = 基本扣除

social_insurance_premium: int = 0 = 社会保险费等金额

small_scale_enterprise_matual_aid_premium :int = 0 = 小型企业互助等应收账款金额

life_insurance_premium_deduction: int = 0 = 人寿保险费用扣除额

earthquake_insurance_premium_deduction: int = 0 = 地震保险费扣除额

medical_expense_deduction: int = 0 = 医疗费用扣除金额

housing_loans_special_deduction: int = 0 = 住房贷款等特别扣除额

income_deduction: int = 0 = 工资收入扣除额

total_deductin:int = 0 = 扣除总额

taxable_income: int = 0 = 应纳税收入金额

resident_tax: int = 0 = 居民税额

donation_amount: int = 0 = 捐赠金额

def start(self):

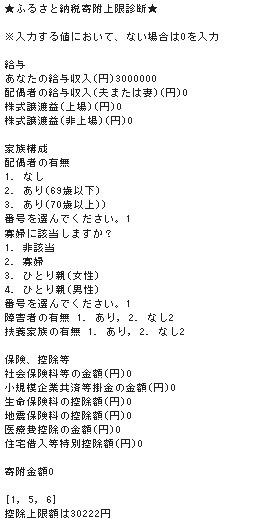

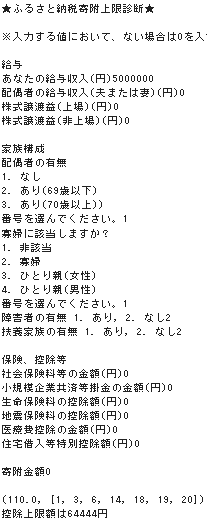

打印(“★家乡纳税捐赠上限诊断★”)

print()

打印(“*输入值,如果没有,则输入 0”)

print()

打印(“工资”)

self.income_section()

print()

打印(“家庭结构”)

self.famiry_section()

print()

打印(“保险、扣减等”)

self.insurance_and_deduction_section()

print()

self.total_deductin = self.social_insurance_premium + self.small_scale_enterprise_matual_aid_premium + self.life_insurance_premium_deduction + self.earthquake_insurance_ premium_deduction + self.earthquake_insurance_premium_deduction + self.medical_expense_deduction + self.housing_loans_special_deduction + self.income_deduction + self.spouse_ deduction + self.widow_deduction + self.handicap_deduction + self.support_deduction + self.basic_deduction

self.taxable_income = self.total_income - self.total_deductin

if self.taxable_income < 0:

self.taxable_income = 0

self.resident_tax = self.taxable_income * 0.1 = 税务会计师说,居民税是“粗略”收入减去扣除金额的 10%

self.donation_amount = int(输入(“捐赠金额”))

print()

calculator = Calculator(self.my_income, self.donation_amount, self.resident_tax)

result = math.floor(calculator.deduction_limit())

return result

def income_section(self):

self.my_income = int(输入(“您的工资收入(日元)”)

self.spouse_income = int(输入(“配偶工资收入(丈夫或妻子)(日元)”)

self.listed_capital_gain = int(输入(“股票转让收益(上市)(日元)”)

self.unlisted_capital_gain = int(输入(“股票转让收益(未上市)(日元)”)

self.total_income = self.my_income + self.spouse_income + self.listed_capital_gain + self.unlisted_capital_gain

def famiry_section(self):

self.__select_spouse()

self.__select_widow()

self.__select_handicap()

self.__select_support()

• 个人总收入

total_income = self.my_income + self.listed_capital_gain + self.unlisted_capital_gain

if self.spouse_income <= 480000:

• 配偶扣除

if self.spouse == 2:

if total_income <= 9000000:

self.spouse_deduction = 380000

elif (total_income > 9000000) and (total_income <= 9500000):

self.spouse_deduction = 260000

elif (total_income > 9500000) and (total_income <= 10000000):

self.spouse_deduction = 130000

else:

self.spouse_deduction = 0

elif self.spouse == 3:

if total_income <= 9000000:

self.spouse_deduction = 480000

elif (total_income > 9000000) and (total_income <= 9500000):

self.spouse_deduction = 320000

elif (total_income > 9500000) and (total_income <= 10000000):

self.spouse_deduction = 160000

else:

self.spouse_deduction = 0

else:

self.spouse_deduction = 0;

else:

• 配偶特别扣除额

if total_income <= 9000000:

if (self.spouse_income > 480000) and (self.spouse_income <= 950000):

self.spouse_deduction = 380000

elif (self.spouse_income > 950000) and (self.spouse_income <= 1000000):

self.spouse_deduction = 360000

elif (self.spouse_income > 1000000) and (self.spouse_income <= 1050000):

self.spouse_deduction = 310000

elif (self.spouse_income > 1050000) and (self.spouse_income <= 1100000):

self.spouse_deduction = 260000

elif (self.spouse_income > 1100000) and (self.spouse_income <= 1150000):

self.spouse_deduction = 210000

elif (self.spouse_income > 1150000) and (self.spouse_income <= 1200000):

self.spouse_deduction = 160000

elif (self.spouse_income > 1200000) and (self.spouse_income <= 1250000):

self.spouse_deduction = 110000

elif (self.spouse_income > 1250000) and (self.spouse_income <= 1300000):

self.spouse_deduction = 60000

elif (self.spouse_income > 1300000) and (self.spouse_income <= 1330000):

self.spouse_deduction = 30000

else:

self.spouse_deduction = 0

elif (total_income > 9000000) and (total_income <= 9500000):

if (self.spouse_income > 480000) and (self.spouse_income <= 950000):

self.spouse_deduction = 260000

elif (self.spouse_income > 950000) and (self.spouse_income <= 1000000):

self.spouse_deduction = 240000

elif (self.spouse_income > 1000000) and (self.spouse_income <= 1050000):

self.spouse_deduction = 210000

elif (self.spouse_income > 1050000) and (self.spouse_income <= 1100000):

self.spouse_deduction = 180000

elif (self.spouse_income > 1100000) and (self.spouse_income <= 1150000):

self.spouse_deduction = 140000

elif (self.spouse_income > 1150000) and (self.spouse_income <= 1200000):

self.spouse_deduction = 110000

elif (self.spouse_income > 1200000) and (self.spouse_income <= 1250000):

self.spouse_deduction = 80000

elif (self.spouse_income > 1250000) and (self.spouse_income <= 1300000):

self.spouse_deduction = 40000

elif (self.spouse_income > 1300000) and (self.spouse_income <= 1330000):

self.spouse_deduction = 20000

else:

self.spouse_deduction = 0

elif (total_income > 9500000) and (total_income <= 10000000):

if (self.spouse_income > 480000) and (self.spouse_income <= 950000):

self.spouse_deduction = 130000

elif (self.spouse_income > 950000) and (self.spouse_income <= 1000000):

self.spouse_deduction = 120000

elif (self.spouse_income > 1000000) and (self.spouse_income <= 1050000):

self.spouse_deduction = 110000

elif (self.spouse_income > 1050000) and (self.spouse_income <= 1100000):

self.spouse_deduction = 90000

elif (self.spouse_income > 1100000) and (self.spouse_income <= 1150000):

self.spouse_deduction = 70000

elif (self.spouse_income > 1150000) and (self.spouse_income <= 1200000):

self.spouse_deduction = 60000

elif (self.spouse_income > 1200000) and (self.spouse_income <= 1250000):

self.spouse_deduction = 40000

elif (self.spouse_income > 1250000) and (self.spouse_income <= 1300000):

self.spouse_deduction = 20000

elif (self.spouse_income > 1300000) and (self.spouse_income <= 1330000):

self.spouse_deduction = 10000

else:

self.spouse_deduction = 0

else:

self.spouse_deduction = 0

if total_income <= 5000000:

• 寡妇扣除

if self.widow == 1:

self.widow_deduction = 270000

• 单亲扣除

elif (self.widow == 2) or (self.widow == 3):

self.widow_deduction = 350000

else:

self.widow_deduction = 0

else:

self.widow_deduction = 0

• 残疾人扣除

if self.has_handicap == 1:

self.handicap_deduction = 270000 * self.handicap['general'] + 400000 * self.handicap['separated_special'] + 750000 * self.handicap['together_special ']

else:

self.handicap_deduction = 0

• 受抚养人扣除

if self.has_support == 1:

self.support_deduction = 380000 * self.support['from_16_to_18'] + 630000 * self.support['from_19_to_22'] + 480000 * self.support['from_23_to_69'] + 580000 * self.support['over_70']

else:

self.support_deduction = 0

def insurance_and_deduction_section(self):

self.social_insurance_premium = int(输入(“社会保险费等金额(日元)”)

self.small_scale_enterprise_matual_aid_premium = int(输入(“小型企业互助等应收账款金额(日元)”)

self.life_insurance_premium_deduction = int(输入(“人寿保险费扣除额(日元)”)

self.earthquake_insurance_premium_deduction = int(输入(“地震保险费扣除额(日元)”)

self.medical_expense_deduction = int(输入(“医疗费用扣除金额(日元)”)

self.housing_loans_special_deduction = int(输入(“住房借款等特别扣除额(日元)”)

• 收入扣除

if self.total_income < 1625000:

self.income_deduction = 550000

elif (self.total_income >= 1625001) and (self.total_income < 1800000):

self.income_deduction = self.total_income * 0.4 - 100000

elif (self.total_income >= 1800001) and (self.total_income < 3600000):

self.income_deduction = self.total_income * 0.3 + 80000

elif (self.total_income >= 3600001) and (self.total_income < 6600000):

self.income_deduction = self.total_income * 0.2 + 440000

elif (self.total_income >= 6600001) and (self.total_income < 8500000):

self.income_deduction = self.total_income * 0.1 + 1100000

else:

self.income_deduction = 1950000

• 基本扣除额

if self.total_income <= 24000000:

self.basic_deduction = 480000

elif (self.total_income > 24000000) and (self.total_income <= 24500000):

self.basic_deduction = 320000

elif (self.total_income > 24000000) and (self.total_income <= 25000000):

self.basic_deduction = 160000

else:

self.basic_deduction = 0

def __select_spouse(self):

打印(“婚姻状况”)

for i, sponse in enumerate(self.spouses):

print(str(i+1) + '. ' + sponse)

自.spouse = int(输入(请选择“编号”)。 '))

def __select_widow(self):

打印(是否属于“寡妇”? ')

for i, widow in enumerate(self.widows):

print(str(i+1) + '. ' + widow)

self.widow = int(输入(请选择“编号”)。 '))

def __select_handicap(self):

self.has_handicap = int(输入(“有无残疾人 1。 是,2. 无'))

if self.has_handicap == 1:

self.handicap [“外在”] = int(输入(“一般残疾人(人)”)

self.handicap ['separated_special'] = int(输入(“个人/分居的特别残疾人(人)”)

自.handicap [“together_special”] = int(输入(“同居特殊残疾人(人)”)

def __select_support(self):

self.has_support = int(输入(“受抚养人的存在或不存在 1。 是,2. 无'))

if self.has_support == 1:

self.support['under_15'] = int(输入('15岁以下'))

self.support['from_16_to_18'] = int(输入('16-18岁')

self.support['from_19_to_22'] = int(输入('19-22岁')

self.support['from_23_to_69'] = int(输入('23-69岁'))

self.support['over_70'] = int(输入('70岁以上'))定义如何以多种方式解决背包问题

class KnapsackProblem():

values: List[int] = []

weights: List[int] = []

max_weight: int = 0

def __init__(self, values, weights, max_weight):

self.values = values

self.weights = weights

self.max_weight = max_weight

def solve_by_qaoa(self):

problem = Knapsack(values=self.values, weights=self.weights, max_weight=self.max_weight)

quadratic_program = problem.to_quadratic_program()

backend = Aer.get_backend('aer_simulator')

quantum_instance = QuantumInstance(backend=backend, shots=800, seed_simulator=99)

min_eigen_optimizer = MinimumEigenOptimizer(min_eigen_solver=QAOA(reps=1, quantum_instance=quantum_instance))

solved = min_eigen_optimizer.solve(quadratic_program)

result = problem.interpret(solved)

print(result)

return result

def solve_by_numpy_eigensolver(self):

problem = Knapsack(values=self.values, weights=self.weights, max_weight=self.max_weight)

quadratic_program = problem.to_quadratic_program()

min_eigen_optimizer = MinimumEigenOptimizer(min_eigen_solver=NumPyMinimumEigensolver())

solved = min_eigen_optimizer.solve(quadratic_program)

result = problem.interpret(solved)

print(result)

return result

def solve_by_ortoolpy(self):

result = knapsack(self.weights, self.values, self.max_weight)

print(result)

return result

def solve_by_pulp(self):

ran = range(len(self.values))

problem = LpProblem(sense=LpMaximize)

var = [LpVariable('x%d'%i, cat=LpBinary) for i in ran]

problem += lpDot(self.weights, var)

problem += lpDot(self.values, var) <= self.max_weight

problem.solve()

result = (value(problem.objective), [i for i in ran if value(var[i]) > 0.5])

print(result)

return result

def solve_by_greedy_algorithm(self):

N = len(self.values)

W = self.max_weight

w = self.weights

v = self.values

dp = [[0]*(W+1) for i in range(N+1)]

for i in range(N):

for j in range(W+1):

if j < w[i]:

dp[i+1][j] = dp[i][j]

else:

dp[i+1][j] = max(dp[i][j], dp[i][j-w[i]]+v[i])

result = dp[N][W]

print(result)

return result

def solve_by_ising_model(self):

def Hamiltonian(x):

B = 10

W = self.max_weight

w_sum = 0

v_sum = 0

for i, w in enumerate(self.weights):

w_sum += w*x[i]

for i, v in enumerate(self.values):

v_sum += v*x[i]

H = B*(W-w_sum)**2-v_sum

return H

def run(H):

N = len(self.values)

T = self.max_weight

ite = 1000

targetT = 0.02

red = 0.97

q = [random.randint(0,1) for i in range(N)]

# q = [1,1,1,1,0,0,0,0,0,0]

while T>targetT:

x_list = np.random.randint(0, N, ite)

for x in x_list:

q2 = copy.copy(q)

y = np.random.randint(0, N)

q2[x] = q[y]

q2[y] = q[x]

dE = H(q2) - H(q)

if np.exp(-dE/T) > np.random.random_sample():

q[x] = q2[x]

q[y] = q2[y]

T *= red

return q

answer = run(Hamiltonian)

result = []

for i, a in enumerate(answer):

if a == 1:

result.append(i)

print(result)

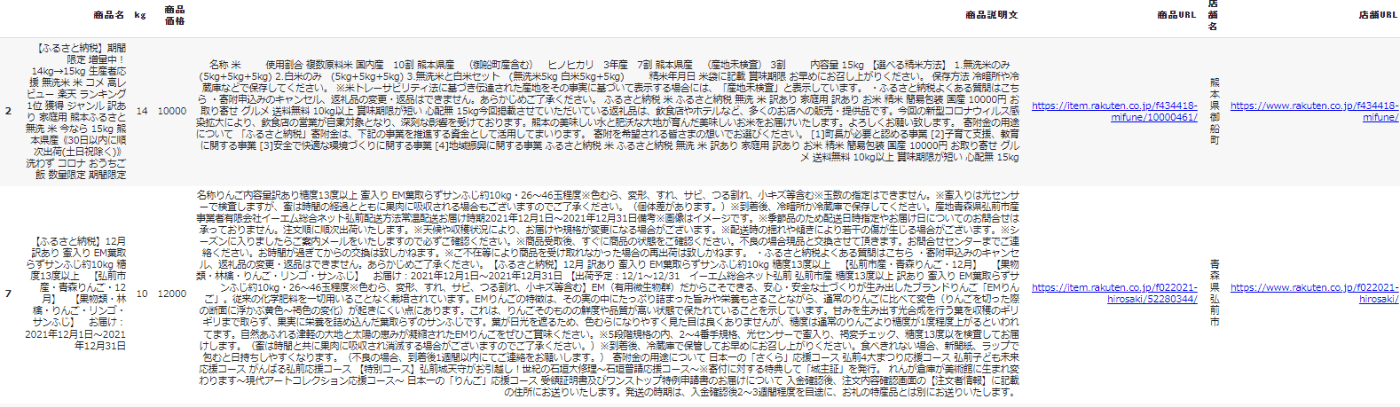

return从乐天 API 获取产品列表

REQUEST_URL = "https://app.rakuten.co.jp/services/api/IchibaItem/Search/20170706"

APP_ID=“<乐天API的应用程序ID>”

serch_keyword = “家乡纳税翻译”

serch_params = {

"format" : "json",

"keyword" : serch_keyword,

"applicationId" : [APP_ID],

"availability" : 0,

"hits" : 30,

"sort" : "standard",

"postageFlag" : 1

}

item_list = []

max_page = 10

for page in range(1, max_page+1):

response = requests.get(REQUEST_URL, serch_params)

result = response.json()

item_key = ['itemName', 'itemPrice', 'itemCaption', 'shopName', 'shopUrl', 'itemUrl']

for i in range(0, len(result['Items'])):

time.sleep(1)

tmp_item = {}

item = result['Items'][i]['Item']

for key, value in item.items():

if key in item_key:

tmp_item[key] = value

item_list.append(tmp_item.copy())

df = pd. DataFrame(item_list)

df.drop_duplicates(subset=['itemUrl'], inplace=True) # 重複删除

df = df.reindex(columns=['itemName', 'itemPrice', 'itemCaption', 'itemUrl', 'shopName', 'shopUrl'])

df.columns = [“商品名称”,“商品价格”,“商品说明”,“商品URL”,“商店名称”,“商店网址”]

df.index = df.index + 1

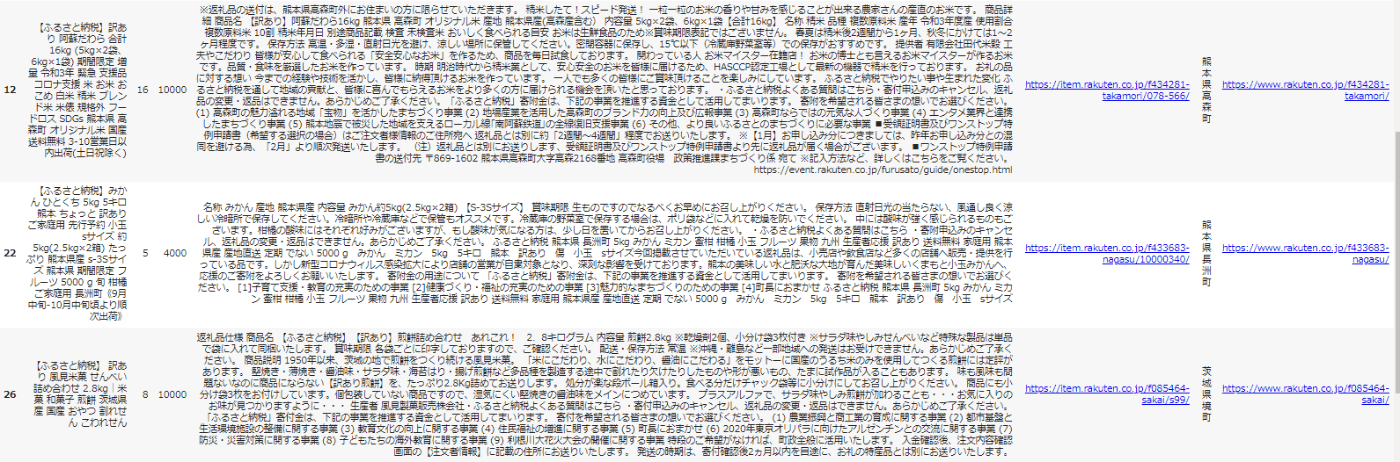

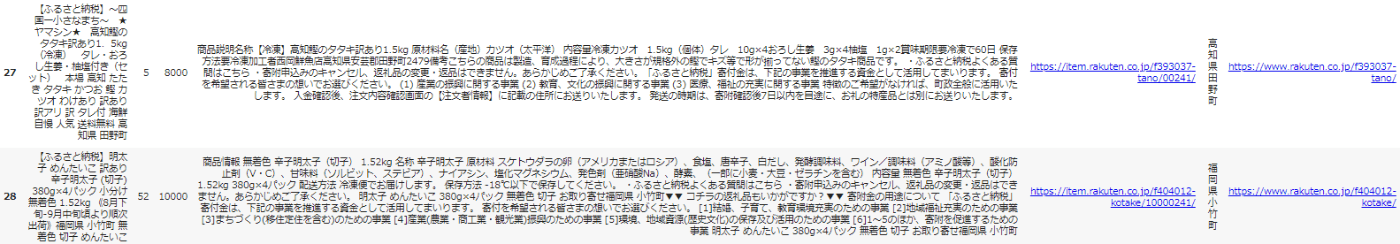

• 仅提取知道数量的产品

weight = df['商品名'].str.contains('kg')

df = df[weight]

df['kg'] = df['商品名'].str.extract('([0-9]+)kg')

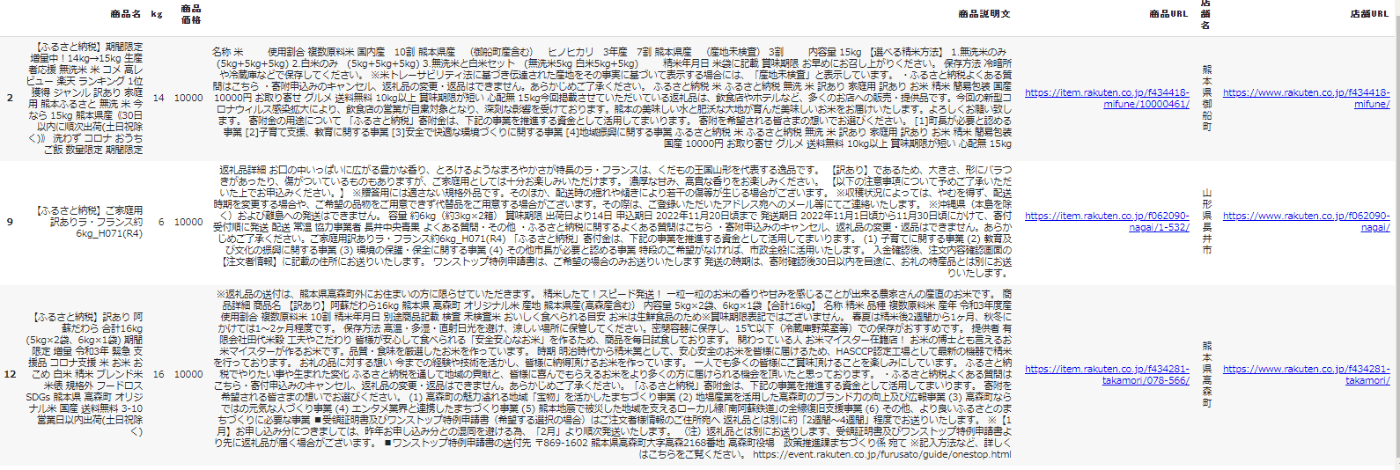

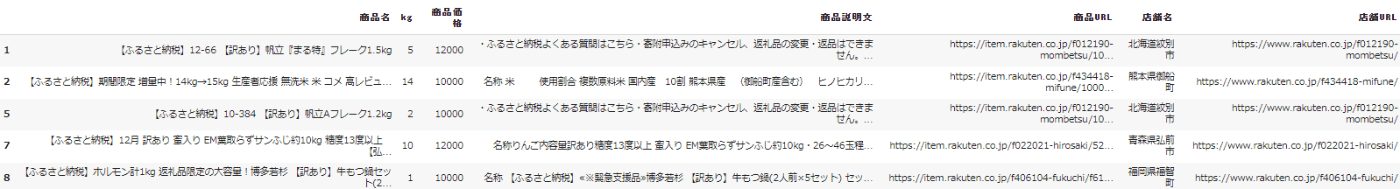

df = df.reindex(columns=[“商品名称”,“kg”,“商品价格”,“商品说明”,“商品URL”,“商店名称”,“商店网址”]数据确认

df.head()

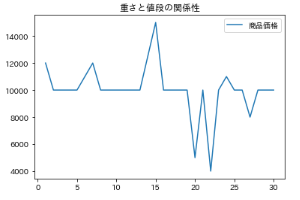

df.plot(标题='重量与价格的关系')

实用解决方案(取决于 ortoolpy)

def practical_solution():

simulator = Simulator()

weights = [int(data) for i, data in enumerate(df['kg'])]

prices = [int(data) for i, data in enumerate(df[商品价格']]]

deduction_limit = simulator.start()

• 背包的价格等是有价值的,并且有重量限制。 在这种情况下,有一个价格限制,以重量的价值。

knapsack_problem = KnapsackProblem(values=weights, weights=prices, max_weight=deduction_limit)

result = knapsack_problem.solve_by_ortoolpy()

打印(f'扣除上限为{deduction_limit}日元')

HTML(df.to_html(render_links=True, escape=False))

def make_clickable(val):

return f'<a target="_blank" href="{val}">{val}</a>'

return df.iloc[result[1]].style.format({'商品URL': make_clickable, '店铺URL': make_clickable})量子算法解决方案 (QAOA)

def futurism_solution():

simulator = Simulator()

权重 = [int(数据) for i,数据在 enumerate(df['kg'])][0:10] = Colab 内存和量子计算机当前性能的 10 个限制(10 个,我什么都不知道,但请原谅)

prices = [int(data) for i, data in enumerate(df[商品价格'])][0:10] # 以上相同

deduction_limit = simulator.start()

• 背包的价格等是有价值的,并且有重量限制。 在这种情况下,有一个价格限制,以重量的价值。

knapsack_problem = KnapsackProblem(values=weights, weights=prices, max_weight=deduction_limit)

result = knapsack_problem.solve_by_qaoa()

打印(f'扣除上限为{deduction_limit}日元')

HTML(df.to_html(render_links=True, escape=False))

def make_clickable(val):

return f'<a target="_blank" href="{val}">{val}</a>'

return df.iloc[result].style.format({'商品URL': make_clickable, '店铺URL': make_clickable})执行

实际解决方案的结果(在扣除上限内选择较重的)

practical_solution()

量子算法求解的结果(从执行开始到结束需要 30 分钟到 1 小时)(在扣除上限内选择较重的解)

futurism_solution()